Accounts Receivable Are Best Described as

Accounts Receivable Manager Job summary 5. Assets of the company representing the amount owed by customers.

What Is Accounts Receivables Examples Process Importance Tally Solutions

Assets of the company representing the amount owed by customers.

. In essence an accounts receivable reconciliation report shows the difference between what customers owe you and how much youve been paid so far. What is an Accounts Receivable Reconciliation. Factoring accounts receivable means selling receivables both accounts receivable and notes receivable to a financial institution at a discount.

The balance in accounts receivable at. Select one or more. Retains the contractual rights to receive the cash flows of the.

Gar received cash as a result of this transaction which is best described as a Since Gar factored its receivables without recourse Ross will have to collect the receivables to the extent possible and will bear the risk of uncollectible accounts. What that adjustment looks like is what will be described below as there are different ways and different methods. How to write off bad debt expense in accounts receivable.

Debtor information is essential to effectively perform skip tracing or asset location refer to OAM 353070 when an account. Bank loan collateralized by the accounts receivable. Liabilities of the company that represent the amount owed to suppliers b.

Amounts that have previously been received from customers. Liabilities of the company that represent the amount owed to suppliers. Insurance Expense would appear on which of the following financial statements.

The transferor maintains continuing involvement. Loan from XYZ collaterized by ABCs accounts receivable b. Sale of Gars accounts receivable to Ross with the risk of uncollectible accounts retained by Gar.

An entity factored accounts receivable without recourse with a bank. State agencies shall to the extent possible collect or verify debtor information when they establish accounts receivable or receive checks for services. Sale of the accounts receivable to the bank with risk of uncollectible accounts retained by the entity.

Additionally Accounts Receivable Analysts are known to earn anywhere from 37000 to 54000 a year. At Clover our Accounts receivables management function is designed to be the complete solution to difficulties that occur in your cash flows and is operated as an extension of your business section. Financial asset but assumes a contractual obligation to pay.

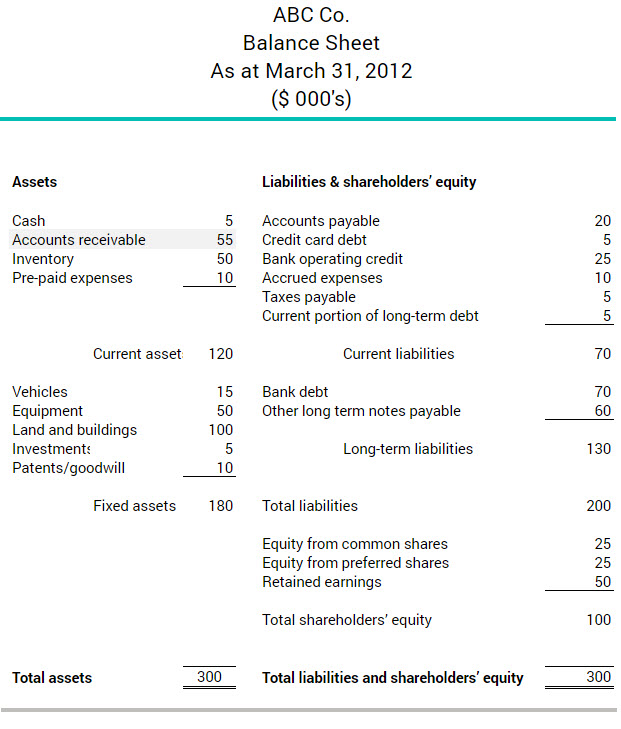

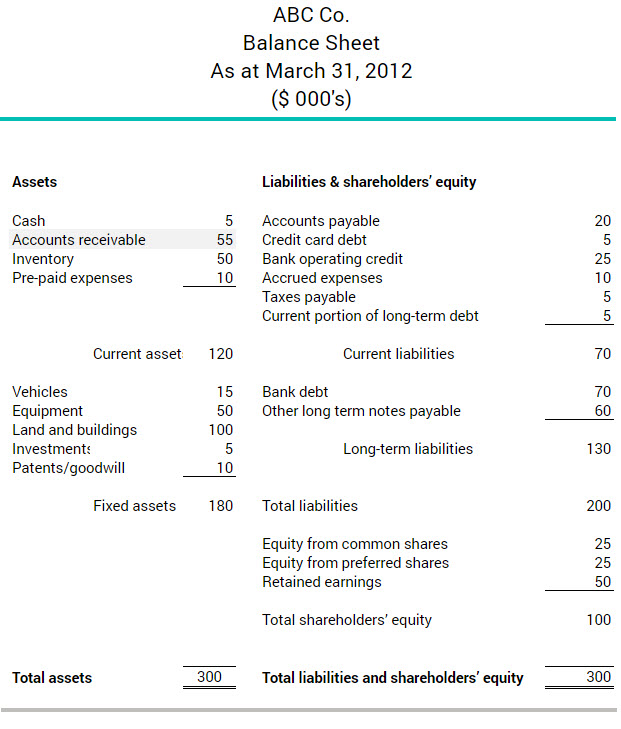

This means that the top-earning Accounts Receivable Analysts make 17000 more than the lowest earning ones. Accounts and notes receivable are reported in the current assets section of the balance sheet at. The largest and normally the most significant asset of all healthcare providers is their accounts receivable.

What is an accounts receivable adjustment. Gar received cash as a result of this transaction which is best described as a. Transfers the contractual rights to receive cash flows of the.

The accounts receivable balance in the general ledger is the total amount owed to you. Accounts receivable are best described as. That meets the pass-through conditions.

The Accounts Receivable Specialist computes classifies and records numerical data to keep financial records complete. Amounts that have previously been paid to suppliers. Performs any combination of routine calculating posting and verifying duties to obtain primary financial data for use in.

Management and collection of accounts receivable. ABC received cash as a result of this transaction which is best described as a. All but one of the following are required before a transfer of accounts receivable can be recorded as a sale.

Amounts that have previously been paid to suppliers. Which of the following best describes accounts receivable. Assets of the company representing the amount owed by customers d.

Accounts receivable is best described as an asset of a business created by one of the businesss customers purchasing a good or service from the business on credit ie. Some of the most basic and essential steps for a typical AR process are. Develop a collection plan.

Amounts that have previously been received from customers c. Liabilities of the company that represent the amount owed to suppliers. Factoring is a common practice among small companies.

The general ledger balances for the accounts receivable and the related allowance account. Apollo Company had net credit sales during the year of 800000 and cost of goods sold of 500000. The cash flows to one or more recipients in an arrangement.

In this role this person will need to have a strong business judgement. Loan from XYZ to be repaid by the proceeds from ABCs account receivable c. Accounts Receivable Analysts average about 2169 an hour which makes the Accounts Receivable Analyst annual salary 45124.

Cash net realizable value. Bank loan to be repaid by the proceeds from the accounts receivable c. The Accounts Receivable Manager will need to work in a team environment with strong leadership team management skills have the ability to meet tight deadlines have keen attention to detail and strong organizational skills.

The bottom line is an accounts receivable adjustment is a debit or a credit applied to the amount a customer owes. Loan from Ross collateralized by Gars accounts receivable. The invoice describes the goods or services that have been sold to the customer the amount it owes the seller including sales taxes and freight charges and when it is supposed to pay.

Ask your clients what day is the. Loan from Ross to be repaid by the proceeds from Gars accounts receivable. Accounts receivable are best described as a.

The institution to whom receivables are. An account receivable is documented through an invoice which the seller is responsible for issuing to the customer through a billing procedure. The entity received cash as a result of this transaction which is best described as.

When the customer fails to pay the business by the later date then the business has an account receivable. When an entity factored accounts receivable without recourse with a bank the transaction is best described as a. Accounts receivable AR is the balance of money due to a firm for goods or services delivered or used but not yet paid for by customers.

Sale of ABCs accounts receivable to XYZ with the risk of uncollectible accounts retained by ABC d. Create invoices to bill to clients at the right time. Invoice of the business to be paid at a later date.

Amounts that have previously been received from customers. Accounts receivable are best described as. Best practices for implementing an accounts receivables process.

What Are Accounts Receivable Bdc Ca

No comments for "Accounts Receivable Are Best Described as"

Post a Comment